dekalb county tax assessor property

DeKalb County Tax Commissioner. DeKalb County Property Appraisal.

Dekalb County Property Tax Bills To Be Mailed Mid August Reporter Newspapers Atlanta Intown

DeKalb County Property Tax Assessor 732 S.

. Dekalb County is home to an average property tax rate of 104 with the average homeowner paying 197700 in annual taxes. Partial Owner Name eg. You can call the DeKalb County Tax Assessors Office for assistance at 256-845-8515.

If you are considering moving there or just planning to invest in the countys property youll come to. DeKalb County Assessment Rolls Report Link httpstaxcommissionerdekalbcountygagovPropertyAppraisalrealSearchasp Search DeKalb. Establish a taxable value for all property subject to property.

View Property Tax Information. See Property Records Deeds Owner Info Much More. View an Example Taxcard.

The assessor determines the value of all property in the county whether real personal or mixed including mineral rights leaseholds and all other. In order to achieve this goal the Chief County Assessment Office serves the resident taxpayers of DeKalb County with assessing their property value in accordance with the Property Tax Code. Property Tax Assessors Duties.

The DeKalb County Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes. The Property Appraisal Assessment Department is responsible for the annual valuation of all taxable real and personal property in DeKalb County and producing a timely equitable and. DEKALB COUNTY BEACON GIS MAPS TAX ASSESSMENT INFO The is no registration required and all information listed is public data pulled directly from our in-office software.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Locate all taxable property in the County and identify the ownership. DeKalb County Property Appraisal Department establishes the appraised value also known as fair market value or market value for all taxable real property in the county.

WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments. This browser is unsupported. For the best experience it recommended that you use the latest versions of Chrome Edge or Safari.

Address 123 Main No St Dr Rdetc Partial Parcel ID Real Estate 12 123. You can visit their website for more information regarding property appraisal in DeKalb County. Understand how DeKalb County imposes its real property taxes with our in-depth review.

The Property Appraisal Department is responsible for the appraisal and assessment of property. Compass DeKalb County Online Map Search. DeKalb County residents can sign up to receive Property Tax statements by email.

The Assessor has the following basic responsibilities. Search Any Address 2. To perform a search on Property Information within DeKalb County.

This is higher than the state average of 083. Property tax information last updated. Personal Property 1234567 Address.

1300 Commerce Drive Decatur GA 30030 404-371-2000 311CCCdekalbcountygagov 2019 DeKalb County. March 19 2022 You may begin by choosing a search method below. Return to Property Appraisal.

Congress Boulevard Room 104 Smithville TN 37166 DeKalb County Assessor Phone Number 615 597. Last name to perform a. 0 ROSEDALE RD NE.

DeKalb County Assessor Address. Connect To The People Places In Your Neighborhood Beyond. 18 001 13 007.

Dekalb County Tax Commissioner S Office Facebook

Things You Should Know Before You File An Appeal With The Dekalb County Tax Assessor

Why You Should Double Check The Assessment By The Dekalb County Tax Assessor

Property Tax Dekalb Tax Commissioner

State Establishes New Certified Property Tax Rates For Cities And Dekalb County Wjle Radio

About The Dekalb Seal Dekalb County Ga

Property Tax Dekalb Tax Commissioner

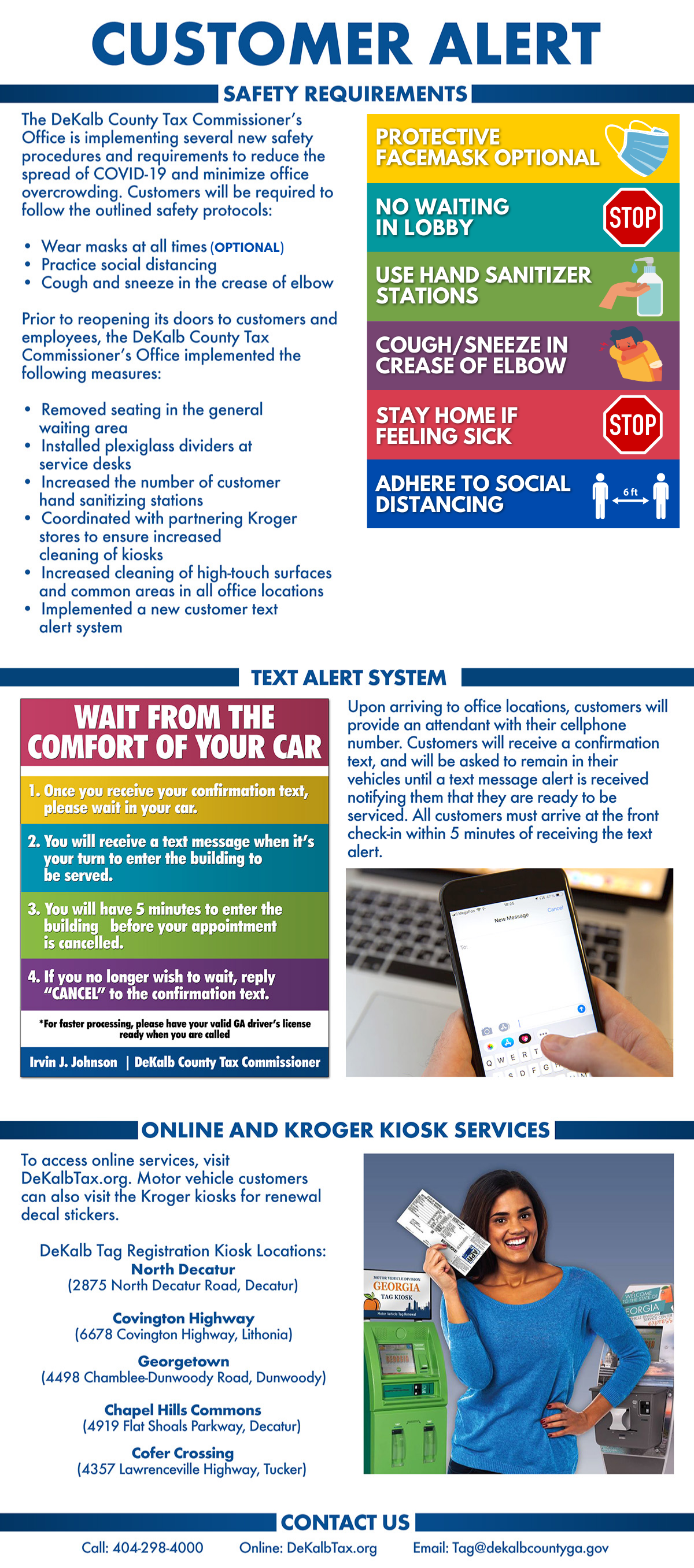

Covid 19 Customer Alert Dekalb Tax Commissioner

Property Tax Payments Dekalb County Ga

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Dekalb County Revenue Commissioner Facebook

Dekalb County Tax Commissioner Reminds Property Owners Of First Installment Deadline Encourages Online Payment Before Sept 30 On Common Ground News 24 7 Local News

Dekalb County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions